retroactive capital gains tax meaning

The top rate for 2021 is 37 plus. Social justice through forced redistribution of wealth.

Understanding The Proposed Retroactive Capital Gains Tax Rate Increase Frazier Deeter Llc

Under existing law the richest Americans pay a top tax rate of 37 on.

. Capital gains are taxed favorably when compared to wage and salary income. The National Law Review points out that in recent years retroactive tax changes have occurred as late in the year as August. Supreme Court has reaffirmed that both income and transfer tax eg estate and gift taxes changes may be implemented retroactively Provided that the retroactive application.

I mean it seems like the with the with the glut of information that we have coming up it seems like the election is like five years away even though its. A Retroactive Capital Gains Tax Increase. First is an accelerating gain realization to a period before the effective date of any legislation.

This would undo the capital gains increase but it could also create fertile ground for lawsuits by those whose family members die between January 1 2010 and the date when any retroactive law is enacted. An old tax collected at the end of a transaction is referred to as a retrospective tax. Individuals would have a 1 million exclusion for capital gains and an additional exclusion of 500000 for a personal residence.

For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. This proposal would be effective for gains required to be recognized after the date of announcement Treasury said. If the proposed legislation is made retroactive but the start date is January 1 2022 this wont be needed but could still be helpful.

Signed 5 August 1997. I can guarantee this. But additionally he wants this implemented retrospectively to April 2021.

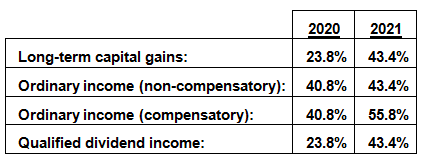

Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the. Those changes usually involve rate decreases however which are typically easier. Short-term capital gains on assets sold within a year are typically taxed as ordinary income.

Ordinary capital gains proceeds from sales of holdings less than a year are still taxed at ordinary rates meaning 37 for those MFJ making more than 628301. Under existing law the richest Americans pay a top tax rate of 37 on ordinary income while the top tax rate on capital. Baucus has pledged to try to restore the estate tax retroactively in 2010.

Effective for taxable years ending after 6 May 1997 ie for the full calendar year in. Accordingly the term retrospective tax generally refers to a tax increase based upon. If they succeed in getting.

Silencing religious opinions counts as diversity. The US Treasury Department on Friday confirmed that the administration is seeking a retroactive effective date on a capital-gains tax rate hike from 20 to 396 for the sliver of households making at least 1 million. Freedom without moral and personal responsibility.

President and Congress hold the power to raise taxes retroactively meaning that the increase could apply anytime during that same calendar year. A previous charge or a new charge is due at the end of any transaction. Long term gains those holdings of more than a year are taxed at 20.

A Multimillion-Dollar Sale No. Bidens expected 6 trillion budget assumes that his proposed capital-gains tax rate increase took effect in late April meaning that it would already be too late for high-income investors to realize gains at the lower tax rates if Congress agrees according to two people familiar with the proposal This is different than what White House economic adviser. A law which retroactively changes tax rates before it is even enacted would be an example of an ex-post-facto law.

Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year. Wealthier investors are also subject to an additional 38 tax on long- and short-term capital gains thats used to fund ObamaCare. Even if the capital gains increase is retroactive they would still save money because the capital gains would be based on a 37 marginal tax rate instead of 396.

This proposal would be retroactive to the beginning of 2021 which. Reduced the maximum capital gains rate from 28 percent to 20 percent. Biden plans to increase this to 434 percent for households earning more than 1 million.

We can be Godless and free. One of the big surprises included in the Biden administrations first budget released the Friday before Memorial Day weekend was the confirmation that President Joe Bidens proposed capital gains. Legally the US.

Capital gains are taxed favorably when compared to wage and salary income. One reason President Biden and key Democrats may want a capital gains tax increase to be retroactive is because there are numerous studies demonstrating that whenever a capital gains tax increase is about to take effect there is a rush of sales realizations and a one-time spike in capital gains tax collections followed by multiple years of lower levels of. Carlton the US.

The five great lies of the Left Wrong. The second planning strategy is charitable giving with appreciated securities.

![]()

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

The Build Back Better Tax Alarmists Who Cried Wolf Wealth Management

Capital Gains Tax A Primer Atlanta Tax

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others

Constitutionality Of Retroactive Tax Legislation Everycrsreport Com

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

2021 2022 Proposed Tax Changes Wiser Wealth Management

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Pdf What Are Capital Gain And Capital Loss Anyway

.png)

Biden S Green Book Includes Retroactive Capital Gains Tax Increase Husch Blackwell Llp Jdsupra

Proposed Impactful Tax Law Changes And What You Can Do Now Johnson Pope Bokor Ruppel Burns Llp

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Managing Tax Rate Uncertainty Russell Investments

Historical Past And Retroactive Capital Gains Rate Modifications T3elearning

Estate Taxes Under Biden Administration May See Changes

Tax Issues And Planning To Consider Before Year End 2020 Kleinberg Kaplan

Biden Tax Proposals Highlights From The Green Book Retroactive Capital Gains Tax Increase And The Repeal Of The Step Up In Basis Among Others